You will earn 8 Virgin Money Points for any settled debit card purchases (not pending), direct debits and BPAY payments from your Virgin Money Go Account. For customers who open a Virgin Money Go Account jointly with another person, the points will be split and evenly allocated to both joint account holders of that account. For further information refer to our Virgin Money Rewards terms and conditions.

The Virgin Money Boost Saver variable Base interest rate plus Bonus interest rate is made up of:

• Base interest rate of 0.05% p.a. and

• Bonus interest rate of 4.15% p.a. if Monthly Criteria is met in the previous calendar month.

The Bonus interest rate applies up to a combined balance of $250,000 on all your Boost Saver's held in the same name as your Virgin Money Go Account. Monthly Criteria will be met when both the following conditions are met:

• Deposit at least $1,000 into your Go Account from another financial institution in the previous calendar month; and

• Make at least 5 settled debit card purchases (not pending), direct debits or BPAY payments in the previous calendar month from your Go Account.

Monthly Criteria is waived for customers between 14-17 years of age. For more information visit the Rates & Fees section.

Subject to the terms and conditions of the Virgin Money Rewards program available here.

The Grow Saver Bonus Interest Rate is unlocked for any calendar month where the below criteria are met during that month:

- Make at least 1 deposit into your Grow Saver; and

- Make no more than 1 withdrawal (including any internal transfers or Pay Someone transfers) out of your Grow Saver

Welcome Offer Criteria: The Virgin Money Go Account comes bundled with the Virgin Money Boost Saver. New Virgin Money Go Account customers will receive 5,000 Bonus Virgin Money Points when they make one (1) debit card purchase, direct debit or BPAY payment from their Virgin Money Go Account in the first 30 days from account opening. Debit card purchases must settle in the first 30 days from account opening (not pending). Cash withdrawals, deposits, refunds, reversals or credits to the Virgin Money Go Account, Pay Someone payments and internal transfers are excluded. For customers who open a Virgin Money Go Account jointly with another person, the Bonus Points will be split and evenly allocated to both joint account holders of that account once the Welcome Offer Criteria have been met. Virgin Money reserves the right to amend or withdraw this offer at any time without notice. A new customer is any person who does not currently or has not previously held a Virgin Money Go Account or Virgin Money Grow Saver. Offer ends 31 January 2026. For further information on the Virgin Money Rewards Program refer to our terms and conditions.

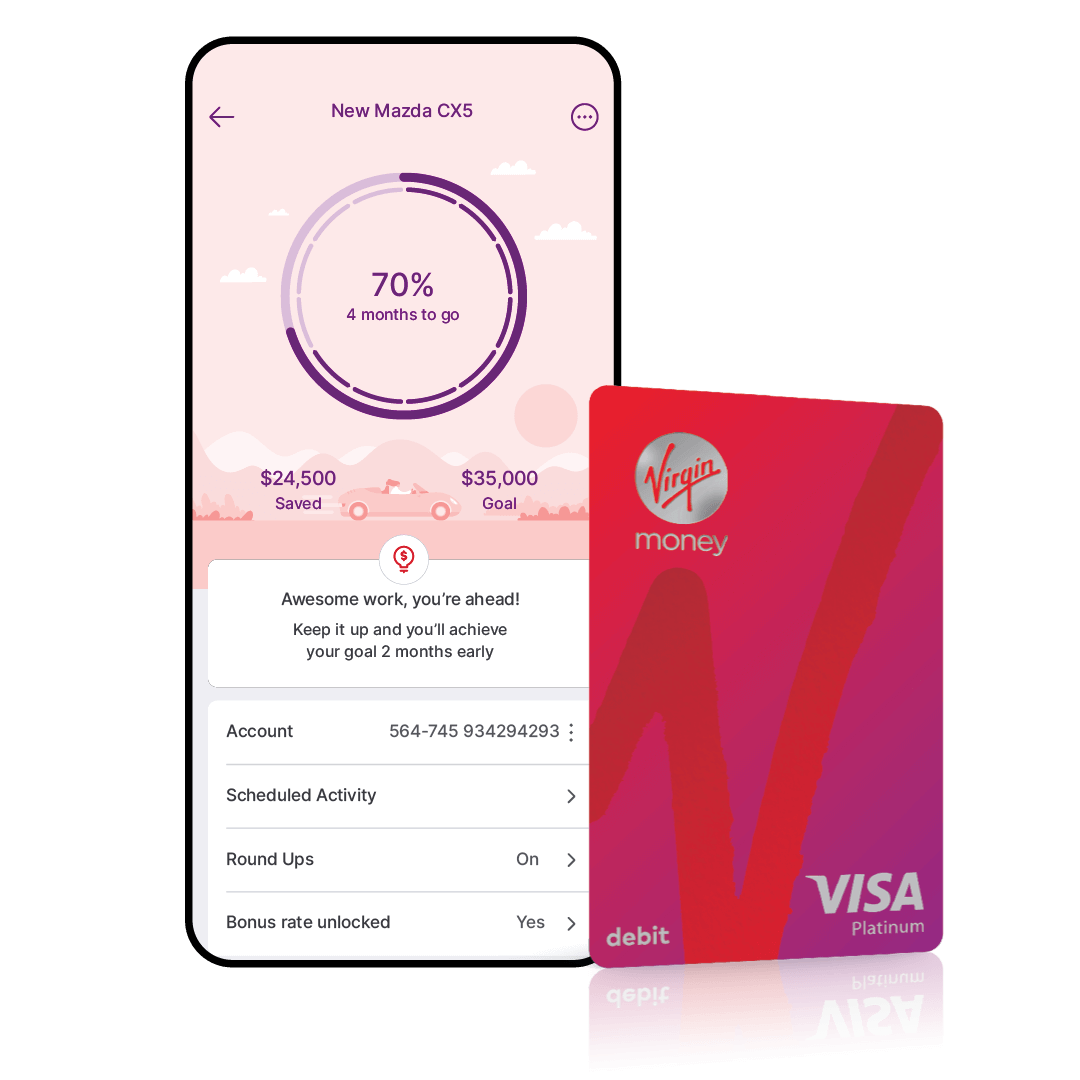

Round-ups are transfers that you can elect to activate on your Go Accounts. By enabling this feature on your Go Account, funds are transferred from the selected Go Account to your nominated savings account each time you make a debit card transaction. The amount of the transfer will be up to the nearest $1 of the amount that the transaction takes place. Round-up transactions will not take place if by making the transaction your account would be Overdrawn. You can disable the round-up feature through the Mobile app at any time.

Visit Apple Support for a list of compatible Apple Pay devices.

Samsung Pay is only compatible with selected Samsung devices. For full list of compatible devices visit Samsung.

Google Pay is a trademark of Google LLC. Google Pay is currently only available on the Virgin Money Go account. It is not available on Virgin Money credit cards.

For customers who open a Virgin Money Go Account jointly with another person, points earned on purchases, direct debits or BPAY payments will be split and evenly allocated to both joint account holders of that account. Any Bonus Points you earn through meeting conditions of a special offer that is made to you will not be split and the full amount of Bonus Points will be allocated to you.

Virgin Money Australia is a division of Bank of Queensland Limited, the issuer of the transaction and savings accounts. Under the Australian Government’s Financial Claims Scheme (FCS), the Financial Claims Scheme limit of $250,000 applies to the total sum of deposits held by an account holder under one banking licence. As part of the BOQ Group, deposits held with Virgin Money (Australia), Bank of Queensland, Me Bank and Bank of Queensland Specialist are covered by the FCS to the maximum limit of $250,000 per account holder. For example, if you have a VMA deposit account and a BOQ deposit account, the FCS applies to the combined value of these accounts to the maximum limit of $250,000.

From time to time we may offer you the ability to earn Bonus Points or other benefits with selected partners. Specific offer terms will be set out individual conditions at the time the offer is made to you.

Earn 5,000 Bonus Virgin Money Points when you introduce a Successful Referral who meets the Welcome Offer Criteria. Welcome Offer Criteria is subject to change. A successful referral must also:

· have not, at any time previously held a Virgin Money Go Account or Virgin Money Grow Saver;

· have used a unique referral link that is provided by Virgin Money as part of the Refer a Friend program which was shared by you.

Bonus Points will be allocated within 5 business days to you and your friend once your friend meets the eligibility criteria. While there is no limit to the number of friends you can refer under our Refer-a-Friend program, you will only receive Bonus Points for the first five (5) successful referrals you made in any month. A successful referral only qualifies you to receive one lot of 5,000 Bonus Points, irrespective of whether the person opens a single or a joint account. This offer cannot be used in conjunction with any other offer codes.

IMPORTANT: Please share your referral link responsibly and only refer close friends and family who might be genuinely interested in a Virgin Money Go Account. Specifically, you must not “spam” other individuals to open a Virgin Money Go Account via unsolicited email, direct mail, newsgroups, message boards, or any other means for purposes of referring a friend. You will only make direct referrals without using any merchant site, keyword bids, black hat SEO, paid advertisements (e.g., pay per click), or other similar methods. You must comply with all applicable laws and regulations, including without limitation those related to the Spam Act 2003 (Cth), trademark, and privacy laws.

We reserve the right to disqualify you from participating in any referral promotions if, in our reasonable opinion, you violated any of these terms, and you will forfeit all Virgin Money Points that have been allocated to your Points balance. We reserve the right to amend or withdraw this offer at any time without notice, provided that any Points that you have earned prior to such change or withdrawal will be subject to the terms that were in effect at the time it was earned.

You may redeem your points for a cash amount in AUD to be credited to your Virgin Money Go Account, Virgin Money Boost Saver or Virgin Money Grow Saver. Once the funds have been credited to an account they cannot be reversed to Points.

Pay with points is available for eligible transactions made within the last 90 days. The full list of eligible transactions can be found in the Virgin Money Rewards Terms and Conditions. You must have sufficient points to be able to redeem the total value of the purchase through Pay with points. If you redeem your points, we will credit a cash amount equal to the selected transaction into your Virgin Money Go Account. Once the funds have been credited to an account, they cannot be reversed to points.

Gift Cards or Vouchers are administered by Ascenda Australia Pty Ltd and are subject to the Ascenda Terms and Conditions. Requested Gift Cards are subject to separate terms and conditions made available at the time of requesting the Gift Card. Once points have been redeemed for a Gift Card, the Gift Card cannot be returned. Expiry dates will apply.

Subject to any conditions we may specify from time to time, you can transfer any Virgin Money Points that you hold in your Rewards Account to another person's Reward Account, provided they have registered for the Virgin Money app.

Offer available while stocks last and limited to one case per household. Valid for new Virgin Wines customers only. Cannot be used in conjunction with any other Virgin Wines offer. $138 savings and free delivery applies to mixed case only – worth $258. RRP of the reds case is $ 249 with savings of $129. RRP of the whites case is $251.97 with savings of $131.97. RRP is as provided by the wineries at time of printing this offer. If a wine becomes unavailable, a similar wine of equal or greater value will be supplied. If you are unhappy with the substitute you can request a refund. Wine chiller bag is available until sold out. All wines are covered by our guarantee - If you don’t like a wine for any reason Virgin Wines will refund you in accordance with our terms and arrange to collect the wine at our cost. No sale contract is formed, and your order is not accepted until we dispatch the product(s) to you. You must be 18 years of age or over to order wine from this site. Wine will not be delivered to persons under the age of 18 years. We do not deliver to parcel lockers and unfortunately, due to rising delivery costs and current liquor laws we are unable to deliver to the Northern Territory. Most orders are fulfilled within a week, but please allow a few extra days if you live in a remote area. Our full terms and Conditions of sale apply to this offer and are available here: www.virginwines.com.au/terms or call us on 1300 712 870. © 2021 Wine People Pty Ltd. LIQP770016550. Level 2, 407 Elizabeth Street, Surry Hills, NSW 2010. All rights reserved.

Standard 12 month membership prices start from $1,872 (more information on memberships is available on Virgin Active’s website). Partner terms and condition apply. To view terms and conditions relating to this corporate offer, and Virgin Active’s standard 12 month membership term.

Earn 5,000 bonus Virgin Money Points when you open your first Virgin Money Go Account and meet the Welcome Bonus criteria:

(2) make at least one debit card transaction that is settled (not pending), direct debit or BPAY payment on your Virgin Money Go Account in the first 30 days of account opening; and

(3) you must a person who does not currently or has not previously held a Virgin Money Go Account or Virgin Money Grow Saver

By opening an a new Virgin Money Go Account and using the unique referral link that was shared by the referrer as part of the Refer a Friend program, and provided you meet the Welcome Bonus Criteria, the person who referred you may be eligible to earn a referral bonus of 5,000 Virgin Money Points. If you already have the Virgin Money app, you can open a new Go Account via the app and manually enter the referral code shared by the referrer.

For customers who open a Virgin Money Go Account jointly with another person under the Refer a Friend program, we will only award one lot of 5,000 Bonus Points and the points will be split and evenly allocated to both joint account holders of that account once the successful referral criteria have been met. This offer cannot be used in conjunction with any other offer codes. Virgin Money reserves the right to amend or withdraw this offer at any time without notice.

Hotel booking made through the Virgin Money Rewards Program are operated by Ascenda Australia Pty Ltd and subject to Ascenda’s additional Booking and Travel Terms. Individual hotel bookings may be subject to further terms and conditions stipulated by Ascenda’s travel partners. These additional terms will be made available to you by Ascenda at the time the relevant booking is made. Points earned from making a Hotel Booking will be credited to your account within 24 hours after the completion of your hotel stay.

Virgin Money Australia is a division of Bank of Queensland Limited, the issuer of the transaction and savings accounts. Under the Australian Government’s Financial Claims Scheme (FCS), the Financial Claims Scheme limit of $250,000 applies to the total sum of deposits held by an account holder under one banking licence. As part of the BOQ Group, deposits held with Virgin Money (Australia), Bank of Queensland, Me Bank and Bank of Queensland Specialist are covered by the FCS to the maximum limit of $250,000 per account holder. For example, if you have a VMA deposit account and a BOQ deposit account, the FCS applies to the combined value of these accounts to the maximum limit of $250,000.

Virgin Money reserves the right to amend or withdraw these offers at any time without notice. To be eligible for points you must access the partner site through the link provided in the application. GST, delivery costs and products that are returned do not contribute to the purchase amount that is eligible for points. These offers cannot be used on conjunction with any other offer. Excludes voucher codes, gift cards, cashback and coupon deals.

Gift Card value correct as at 30 September 2022 and subject to change without notice. Gift Cards or Vouchers are administered by Ascenda Australia Pty Ltd and are subject to the Ascenda Terms and Conditions. Requested Gift Cards are subject to separate terms and conditions made available at the time of requesting the Gift Card. Once points have been redeemed for a Gift Card, the Gift Card cannot be returned. Expiry dates will apply.

Welcome Offer Criteria: Offer ends 31 May 2022. New Virgin Money Go Account customers will receive 20,000 bonus Virgin Money Points when they spend $100 or more in the first 30 days on their debit card (settled transactions, not pending) from account opening. Excludes direct debits and BPAY payments. For customers who open a Virgin Money Go Account jointly with another person, we will only allocate one lot of 20,000 bonus points and the points will be split and evenly allocated to both joint account holders of that account once the Criteria have been met. Virgin Money reserves the right to amend or withdraw this offer at any time without notice. Offer cannot be used in conjunction with any other offer. For further information on the Virgin Money Rewards Program refer to our terms and conditions.

New Referees will receive 5,000 Bonus Virgin Money Points when they open their first Virgin Money Go Account before 31 January 2026 and meet the Welcome Offer Criteria:

(1) Make one (1) debit card purchase, direct debit or BPAY payment from their Virgin Money Go Account in the first 30 days from account opening. Purchases must settle in the first 30 days from account opening (not pending); and

(2) Must not currently or have not previously held a Virgin Money Go Account or Virgin Money Grow Saver

(3) Cash withdrawals, deposits, refunds, reversals or credits to the Virgin Money Go Account, Pay Someone payments and internal transfers are excluded.

By opening an a new Virgin Money Go Account and using the unique referral link that was shared by the referrer as part of the Refer a Friend program, and provided you met the Welcome Offer Criteria, the person who referred you may be eligible to earn a referral bonus of 5,000 Virgin Money Points. If you already have the Virgin Money app, you can open a new Go Account via the app and manually enter the referral code shared by the referrer.

For customers who open a Virgin Money Go Account jointly with another person under the Refer a Friend program, we will only award one lot of 5,000 Bonus Points and the points will be split and evenly allocated to both joint account holders of that account once the successful referral criteria have been met. This offer cannot be used in conjunction with any other offer codes. Virgin Money reserves the right to amend or withdraw this offer at any time without notice. For further information on the Virgin Money Rewards Program refer to our terms and conditions at https://virginmoney.com.au/virgin-money-app/in-app/terms-and-conditions.

ATM access is free via the Redi Teller Network, Bank Of Queensland and the 4 major retail banks. Although Virgin Money doesn’t charge domestic ATM withdrawals fees, some financial institutions or independent ATM operators may charge fees for using their ATMs and there are fees for balance enquiries and international ATMs.

Other Fees and Charges apply, refer to Deposit Account Limits, Fees and Charges

Redemption value is correct as at 1 August 2022 and subject to change without notice. Gift Cards or Vouchers are administered by Ascenda Australia Pty Ltd and are subject to the Ascenda Terms and Conditions. Requested Gift Cards are subject to separate terms and conditions made available at the time of requesting the Gift Card. Once points have been redeemed for a Gift Card, the Gift Card cannot be returned. Expiry dates will apply.

The Virgin Money Grow Saver highest Variable Interest Rate of 2.30% p.a. is made up of

• a Base Interest Rate of 0.05% p.a.;

• a Bonus Interest Rate of 1.95% p.a. if Monthly Criteria is met in that month; plus

• a Notice Interest Rate of 0.30% p.a. if the Lock Saver Feature is enabled.

Monthly Criteria is met if you:

• Make at least 1 deposit into your Grow Saver Account in that month; and

• Make no more than 1 withdrawal (including any internal transfers or Pay Someone transfers) out of your Grow Saver.

For more information visit the Rates & Fees section.

The Virgin Money Boost Saver Highest Variable Interest Rate is made up of:

• Base Interest Rate of 0.05%p.a.;

• Bonus Interest Rate of 4.15%p.a. if Monthly Criteria is met in the previous month; and

• Notice Interest Rate of 0.30%p.a if the Lock Saver Feature is enabled.

32 days’ advance notice period applies to access funds when the Lock Saver Feature is enabled.

The Bonus Rate applies up to a combined total balance of $250,000 across all Boost Saver's that are held in the same name. Monthly Criteria will be met when both the following conditions are met:

• Deposit at least $1,000 into your Go Account from another financial institution in the previous calendar month; and

• Make at least 5 settled debit card purchases (not pending), direct debits or BPAY payments on your Go Account that settle in the previous calendar month from your Go Account.

Monthly Criteria is waived for customers between 14-17 years of age. For more information visit the Rates & Fees section.

TBC 32 day notice disclaimer

Transferring points into a travel program is subject to the Virgin Money Rewards terms and Conditions found here . You can transfer and convert your Virgin Money Points to a Travel Loyalty Program participant that you are an active member of. Points cannot be transferred to another person or to an account held jointly with another person. Travel Loyalty Program’s loyalty points cannot be converted to Virgin Money Points. Minimum and maximum redemption rates are set by us and vary across each program. Points transferred to a Travel Loyalty Program will be governed and subject to the Travel Loyalty Program terms and conditions and once transferred cannot be reversed.

You can redeem points for flights and hotels available in the Rewards Hub. Flight and Hotel bookings made through the Virgin Money Rewards Program are operated by Ascenda Australia Pty Ltd and subject to Ascenda’s additional Booking and Travel Terms. Individual flight and hotel bookings may be subject to further terms and conditions stipulated by Ascenda’s travel partners. These additional terms will be made available to you by Ascenda at the time the relevant booking is made. Cancellations and changes to bookings may not be possible and additional fees may apply which are disclosed in the Rewards Hub.

Under the Australian Government’s Financial Claims Scheme (FCS), certain deposits are protected up to a limit of $250,000 for each account holder. The FCS limit of $250,000 applies to the total sum of all Virgin Money Australia bank accounts, including accounts you hold with BOQ, ME Bank, and BOQ Specialist. Visit this website (https://www.apra.gov.au/financial-claims-scheme-0) for further information on the institutions and types of accounts covered.